When I first starting working in television in the late noughties, my colleagues in commissioning, scheduling and production almost exclusively viewed other terrestrial TV channels as their competitor set. Did Strictly outperform Britain’s Got Talent last night? What was BBC One’s share relative to ITV1?

Fast forward 15 years and the focus has definitely broadened. How are we doing relative to YouTube and the SVODs with different demographics? How successful was Squid Game? To what extent is on-demand viewing offsetting the decline in broadcast TV viewing?

However, Ofcom’s latest Media Nations report highlights a new elephant in the room - TikTok.

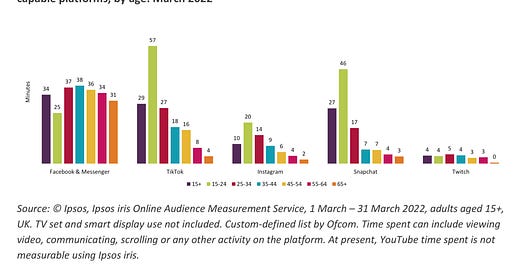

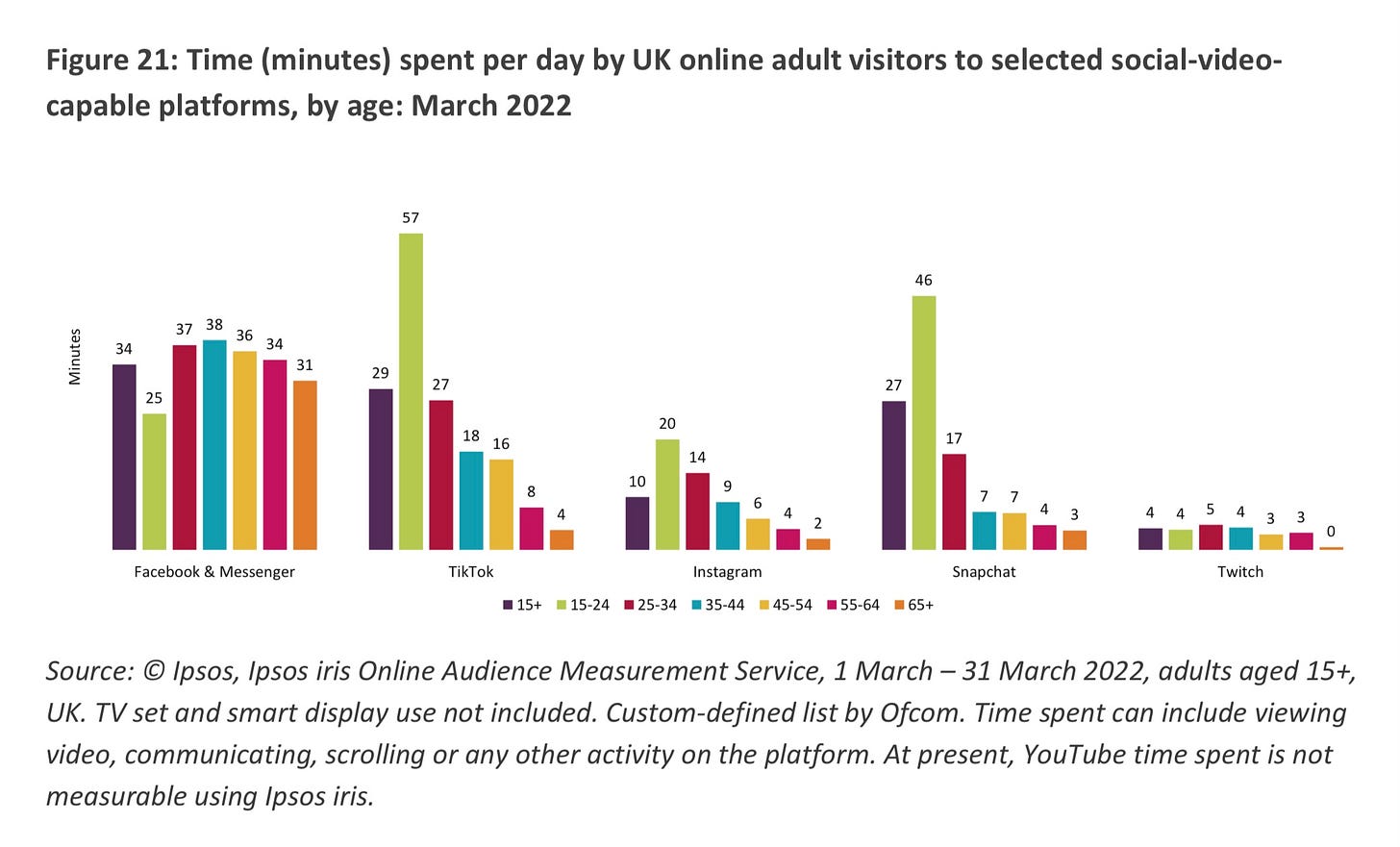

Whilst YouTube remains the largest social video platform in the UK in terms of reach (92% of UK adult internet users, to TikTok’s 35%), the gap is closing amongst online 15-24s (of whom TikTok now reaches 66%), especially in relation to time spent. The 5 million UK 15-24-year-olds who do use TikTok spend an average of 57 minutes per day on it.

And it’s not just youngsters. The 4.2m 25-34-year-old users of TikTok are averaging 27 minutes per day, The 3.2m 35-44 year-old users 18 minutes and the 2.6m 45-54-year-old users 16 minutes.

That’s 2.6 million 45-54-year-olds watching almost 2 hours of TikTok a week. Ofcom’s 2020 Media Nations reports didn’t even mention TikTok.

So, what’s a media company to do about TikTok?

Let’s start with some things not to do:

1.) Don’t try to clone TikTok (I’m looking at you, Zuckerberg)

2.) Don’t assume clips from your TV shows are going to magically find a new audience on TikTok

3.) Don’t count TikTok in your reach figures (most viewers won’t attribute the content to you)

Ok, so what should they do?

1.) Think about the simplicity of the TikTok user experience when designing your digital products

2.) Create content specifically for TikTok that users will want to like/share and that will raise awareness/appreciation of your key brands

3.) Accept that your overall share of viewing time is likely to decline and that you therefore need to deliver greater impact from fewer viewing hours

Ofcom (and the research agencies they commission) could help by providing a more holistic view across TV, streaming and social video platforms.

Whilst TV and streaming data is now increasingly being viewed in the round, social video platforms tend to be reported on separately and differently, making comparisons tricky. For example, it’s hard to reconcile the viewing amongst 16-24s and 25-34s in Figure 21 (Ipsos data) with the 19 minutes of ‘Other video’ viewing amongst 16-34s in Figure 3 (a patchwork of BARB, Comscore and TouchPoints data).

At a time when many of the social giants are grappling with a slowdown in growth, TikTok shows no sign of slowing down and looks to have plenty of headroom to grow its share of the viewing pie. Are you ready for it to take a(nother) bite out of your slice?

Figure 3 not attached, or am I missing something?