Video streaming round-up + the future of live TV

Netflix subs fall, CNN+ closure, Sky & Virgin’s IP-only boxes, Live on Disney+

To my mind the most remarkable thing about the two biggest streaming stories of the last few weeks is how ultimately unsurprising they both were.

Netflix subs fall

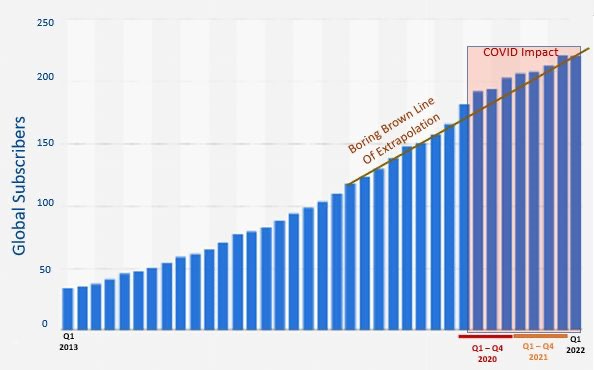

Netflix’s first quarter of negative subscriber growth has been in the post for a while, thanks primarily to the unsustainable increases delivered through the height of the pandemic (all that enforced staying at home) and exacerbated by recent price increases, competitor growth, the economic downturn and a bit of a content dry spell (see previous post).

You wouldn’t guess it from the market’s reaction, but last quarter’s subscriber numbers were up by a third (55 million subs) on the last pre-pandemic quarter (Q4 2019). Not too shabby and very much in line with their pre-pandemic growth trend, as illustrated by the below chart from Mark Ritson (discovered via this excellent post from Gary Andrews, whose Substack is well worth subscribing to).

Whilst it was cutting loose 700k Russian subscribers that tipped the scales for Netflix last quarter, its stakeholder expectation-setting suggests the current quarter might see voluntary cancellation numbers large enough to result in another quarter of negative growth (its saying its expecting to lose 2 million subscribers this quarter).

CNN+ closure

Whilst few would have predicted it would have quite such a short-lived existence (32 days!), the closure of CNN+ also had an air of inevitability about it. The subscriber projections (2 million in the service’s first year, and 15-18 million after four years) were always likely to end in disappointment, especially considering the absence of the core CNN channels (due to tie-ups with US cable networks).

The timing of the decision looks like a result of fresh pairs of eyes on those projections following the Warner Bros Discovery merger and a more sober assessment of the likely fortunes of a standalone news SVOD service, rather than a knee-jerk reaction to the first few weeks’ subscriber numbers.

Sky & Virgin’s IP-only boxes

Generating fewer headlines, but also from the ‘when’ rather than ‘if’ drawer, Sky and Virgin Media have both announced standalone IP-only streaming boxes.

The Sky Stream puck isn’t actually new but has previously only been available with the purchase of a Sky Glass TV, limiting its uptake to those willing to commit a minimum of £634. Whilst Sky hasn’t yet announced how much a standalone the Sky Stream puck will cost, it’s likely to have broader appeal than Sky Glass TV, which Sky sensibly gave some time on its own in the market for well-heeled early adopters to sign up for.

Virgin Media’s IP-only box, also called Stream, was announced two weeks after Sky’s but is already available to order (the timing of Sky’s announcement looking suspiciously like a deliberate spoiler ahead of Virgin’s). The two boxes are fairly similar in both form and functionality. Both offer all the major streaming apps (Disney+ making it’s belated debut on Virgin Media) and 2022 hygiene features like voice control and UHD.

Rather than attempting to outdo Sky on functionality, Virgin has sensibly opted to position price and flexibility as the key selling points of their proposition. In addition to a relatively modest one-off activation fee of £35 for both new and existing Virgin Media broadband customers, with no ongoing charges for the core service, Virgin is offering “Stream Credit”, which promises customers 10% off their SVOD subscriptions if they add them via their Virgin Media bill (enough to offset Netflix’s recent price increase on its Standard plan). They’re also promising customers “a fuss-free 30-day rolling contract so they can add or remove subscriptions every month”.

The only rub here is that customers cannot port existing SVOD subscriptions to their Virgin Media bill, meaning they will need to create new accounts to receive the 10% discount and in so doing bid farewell to their viewing histories, watch lists and personal recommendations (something I’d personally welcome after our cat sitters binged horror films on my Netflix profile).

Whilst Sky customers do have the option of subscribing to Netflix via Sky’s Ultimate package (which bundles Sky & Netflix for £26 a month), its only one provider, the savings are less clear and there’s much less flexibility (the ultimate package requires an 18-month contract). It will be interesting to see if and how Sky responds to Virgin’s Stream Credit, which feels well timed in view of the cost of living crisis.

Live on Disney+

Following a low-key test with the Oscar nominations, Disney+ is entering the live streaming arena in a big way this autumn with the transfer of Dancing with the Stars (the US version of Strictly Come Dancing) from ABC, Disney’s broadcast TV network, which has been its home for 30 seasons across 16 years.

Whilst ratings for Dancing with the Stars have more than quartered from the giddy highs of 2010 & 2011, when the series averaged 21.9m viewers, to 4.9m for last year’s outing (vs Strictly which averaged 9.6m for last year’s series - down just 1.6m on its 2010 high of 11.2m), it’s still a bold move and one that is consistent with Disney’s level of commitment to Disney+.

That said, whilst Disney have described it as a “move to a new home”, they haven’t definitively stated that it won’t also get a broadcast transmission.

The future of live TV

Either way, I’m hoping that the increase in live on streaming services (something the BBC began on iPlayer way back in 2008 https://www.bbc.co.uk/pressoffice/pressreleases/stories/2008/08_august/22/simulcast.shtml) will finally bring about an end to the erroneous ‘on demand will kill live/linear’ declarations that have persisted for years and which seem rooted in a conflation of delivery network (whether the 1 and 0s are being delivered over broadcast or IP) with whether those 1s and 0s are being presented as a live stream or an on demand asset.

Yes, broadcast TV viewing will continue to decline, but live will continue to be an important part of the viewing ecosystem for as far as the eye can see. And not just for events that are happening now (e.g. breaking news, sport, live entertainment); live presentation can also work for shows that are already in the can S3 bucket, but where viewing synchronously is an active selling point, which can apply as much to must-see-before-you-encounter-a-plot-spoiler drama (e.g. Line of Duty, Succession) as much as it’s-fun-to-follow-the-twitter-hashtag entertainment formats (e.g. Love Island, The Apprentice).

Whilst it’s possible to arrange to watch a programme synchronously with a few friends using WatchParty, Disney’s GroupWatch or Apple’s SharePlay, it requires more effort and coordination than just all rocking up independently at a pre-advertised time.

Whilst they won’t be the dominant force they have been historically, I also believe linear channels have a role to play in the future viewing ecosystem. In a sea of what can feel like infinite choice, linear channels can play a role in giving users a break from browsing through rails of content and having to actively make a decision to commit to an individual title by pressing play - instead, someone else has decided this programme is worth watching tonight and I know I’ll be doing so along with thousands, if not millions, of others.

Linear channels can also be effective in drawing you in to programmes you would never have decided to press play on, either because you tune in half way through or because it autoplays after a programme you had actively chosen to watch.

This happened a few weeks ago when I spotted a promo for The Guardian in the menu bar of my Samsung TV. Intrigued, I selected it and was thrown into the middle of a documentary about Brazilian LGBT activists. I had stumbled into The Guardian’s recently launched FAST (Free Ad-supported Streaming TV) channel and was instantly absorbed by a programme I would have been unlikely to have found and pressed play on in a VOD interface.

Whilst streaming services have attempted to replicate this attribute of linear channels through the use of autoplay, viewers have a different expectation of what will happen at the end of a programme they’ve started watching on demand vs a programme they’ve caught on a linear channel. If BBC One or ITV2 stopped after the programme you’d tuned in you’d most likely think something had gone wrong (with your TV, broadband or at the broadcaster’s end). By contrast, a programme autoplaying after the one you’ve chosen to watch on Netflix or BBC iPlayer still feels, well, a bit rude.

Against this backdrop, it’s interesting to see pure VOD players like Netflix experimenting with IP-delivered linear channels.

Of course, the lines between live and on demand have become increasingly blurry thanks to innovations like Live Restart and autoplaying recommendations, although I believe the desire to watch certain types of programming synchronously will persist and the simplicity of linear channels will ensure they remain in the mix as IP takes over from broadcast as the primary way in which TV is delivered to our eyeballs.