Amazon Freevee and the quiet rise of Free Ad-Supported Streaming TV

Heard of Freevee? Not Freeview, Freevee. It’s the new name for Amazon’s free ad-supported streaming service. Formerly known as IMDb TV, it launched in the US in 2019 and was rolled out to the UK last year.

It’s one of a number of Free Ad-Supported Streaming TV (FAST) services which have been quietly growing their content offer and their audience over the last few years.

As well as being free and ad-supported (so no subscription required), FAST services typically offer a blend of IP-only linear channels alongside an on-demand catalogue.

There are three main operators of FAST services: established media corporations (Comcast, Fox Corp, Paramount), streamers (Amazon, Plex, Roku) and OEMs (Samsung, LG), although the lines can get blurry behind the scenes (LG Channels, for example, is powered by XUMO and Pluto TV, which are owned by Comcast and Paramount respectively).

Whilst most FAST service operators haven’t made usage figures public, those that have suggest there may be some gold in them hills. Paramount reported Pluto TV had 68 million monthly active users (MAUs) last quarter and Fox reported 51 million MAUs for Tubi. Samsung haven’t revealed MAUs for Samsung TV Plus, but claim it’s one of the five most-used apps on their smart TVs (presumably behind YouTube, Netflix, Disney+, Amazon Prime Video) and the second most popular free streaming app (behind YouTube).

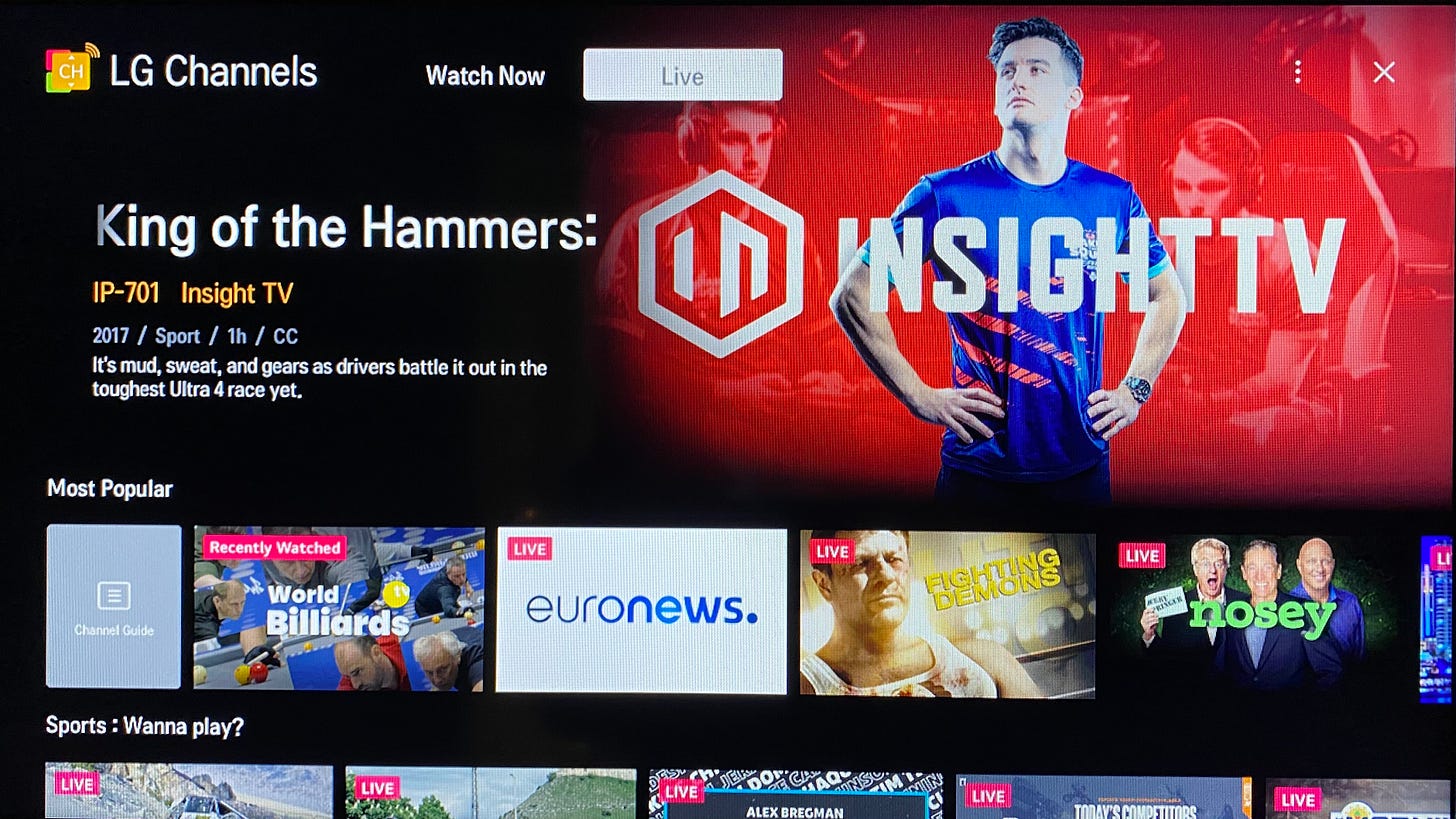

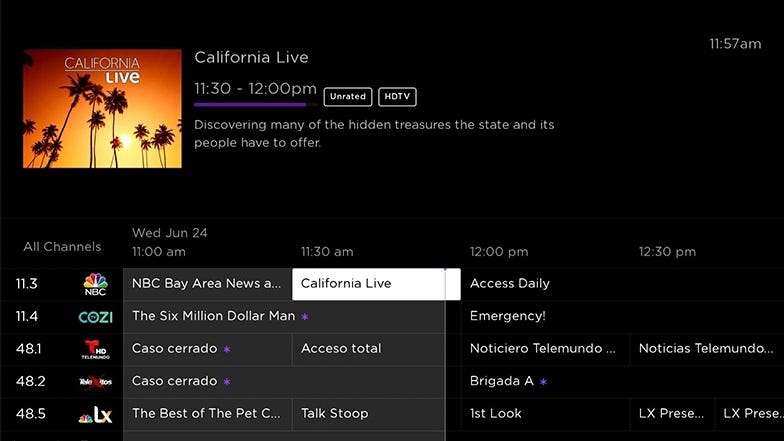

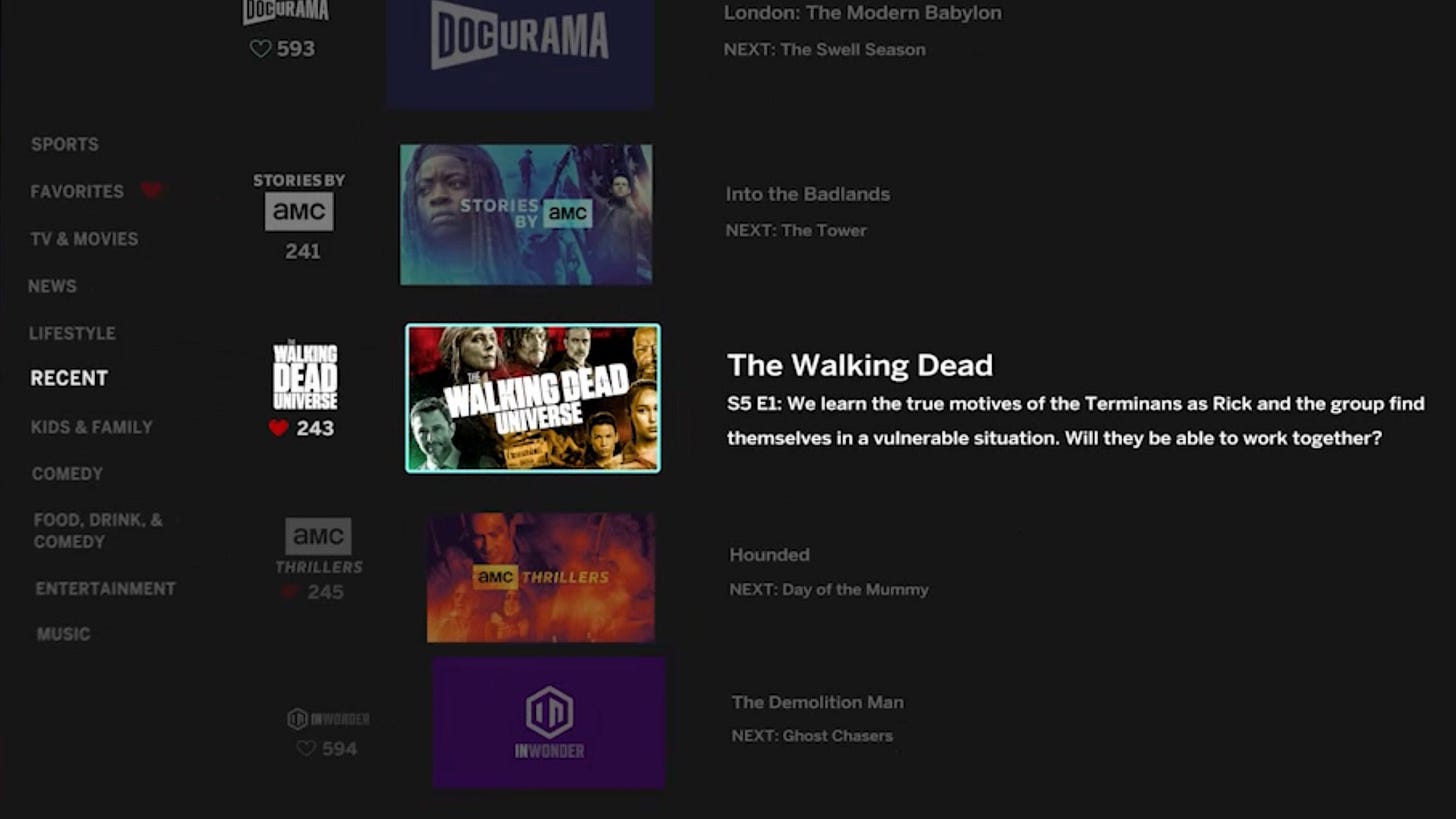

I wrote last month about the role linear channels can play in an IP viewing landscape and it’s interesting to note the degree to which FAST services are choosing to emulate the presentation of broadcast TV. Most feature a traditional EPG, autoplay a channel on app launch/navigation to the Live TV tab and support up/down channel change. Samsung has integrated FAST channels into its main EPG and LG Channels has even adopted the channel change button as its logo.

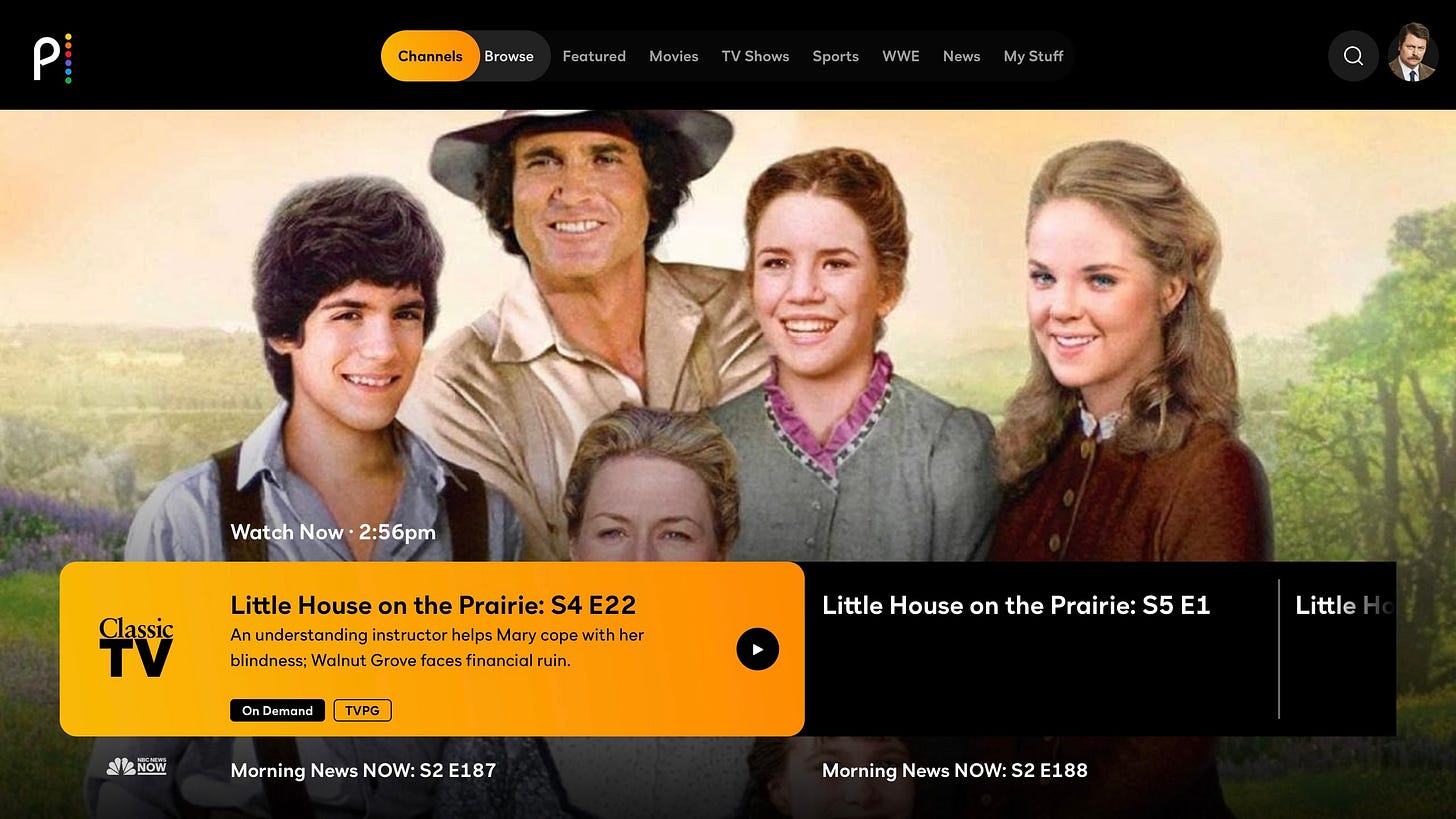

Most FAST channels are genre or programme-based and unsurprisingly tend to favour formats without a narrative arc across episodes. Common channel genres include lifestyle, true crime, the paranormal, niche sports/gaming and nature documentaries. Programme-based channels are often reality (e.g. Hell’s Kitchen, Judy Justice, Bridezillas), children’s (e.g. Inspector Gadget, Sabrina, Teletubbies) or lightweight/retro drama (e.g. Baywatch, The Bold and the Beautiful, The Nanny).

Brand-based FAST channels are also starting to become more commonplace, with The Guardian recently dipping its toes in the water.

In addition to ‘Live’ (linear) channels, Freevee also presents on-demand content as rows in the EPG, such as a ‘Popular TV’ row featuring first episodes of narrative series.

Below is a round-up of a dozen of the most popular FAST services, half of which are currently available in the UK.

Looking ahead, Samsung & LG look well placed to grow usage of their FAST propositions thanks to their control over the UI on two of the most popular brands of connected TV (Samsung promote TV Plus heavily in their menu bar). Similarly, Roku in the US, where they have impressive market share. Amazon are also well placed thanks to their ability to leverage Prime Video and the Fire TV UI, which (alongside Google TV, which has already integrated Pluto TV into its UI) will be adopted by an increasing number of low-mid range TV OEMs.

FAST operators without control of a device UI may find it harder to cut-through with their branded D2C services and end up focussing on providing FAST channels to those who do and/or rolling their FAST channels into their SVOD propositions (a la Peacock). Comcast certainty has some thinking to do now its acquired its way to operating Peacock, XUMO and VUDU (a TVOD/AVOD joint venture with Warner Bros. Discovery).

As the SVOD market looks like it’s finally reaching saturation point (sorry Paramount+), it looks like there’s still headroom in the FAST channels arena, although (as always) prominence enabling discovery will be key.

If you found this post interesting, please consider liking it and/or sharing it. Thanks :)

Freevee (formerly IMDb TV)

Owner: Amazon

Launched: 2019 (2021 in UK)

Territories: UK & US

Linear IP channels: 60+

On-demand catalogue: 2,000+ titles

Devices: Available as an Channel on Amazon Prime Video (and as a standalone app on Amazon Fire TV devices)

LG Channels (formerly LG Channel Plus)

Owner: LG

Launched: 2015

Territories: 14 incl. UK, US, Canada, France, Germany, Spain, Brazil, Mexico

Linear IP channels: 190+ (UK)

On-demand catalogue: N/A

Devices: LG Smart TVs

Peacock

Owner: Comcast

Launched: 2020

Territories: US

Linear IP channels: 58+

On-demand catalogue: 7,500+ hours

Devices: Samsung Smart TVs, LG TVs, Roku, Playstation, Xbox, Vizio SmartCast TVs, Xfinity, iOS, Android

Plex

Owner: Plex

Launched: 2008 (FAST added 2020)

Territories: Worldwide with a few exceptions

Linear IP channels: 250+

On-demand catalogue: 50,000+ titles

Devices: Roku, Amazon Fire TV, iOS, Android, Samsung Smart TVs, LG Smart TVs, PlayStation, Xbox

Pluto TV

Owner: Paramount

Launched: 2013

Territories: UK, US, Spain, France, Latin America, Australia

Linear IP channels: 250+

On-demand catalogue: 2,000+ titles

Devices: iOS, Android, Roku, Samsung Smart TVs, LG Smart TVs, PlayStation

Rakuten TV Free

Owner: Rakuten

Launched: 2021

Territories: 14 incl. UK, Spain, France, Germany and Japan

Linear IP channels: 90+

On-demand catalogue: 600+ titles

Devices: Samsung Smart TVs, LG Smart TVs, Panasonic Smart TVs, Hisense Smart TVs, Philips Android TVs, Vestel Smart TVs, iOS, Android

The Roku Channel

Owner: Roku

Launched: 2017

Territories: UK, US, Canada

Linear IP channels: 250+ (US & Canada)

On-demand catalogue: 2,000+

Devices: Roku, NOW TV, Sky Q, Hisense TVs

Samsung TV Plus

Owner: Samsung

Launched: 2016

Territories: 23 incl. UK & US

Linear IP channels: 100+

On-demand catalogue: Size unknown

Devices: Samsung Smart TVs, Samsung Galaxy phones/tablets (running Android 8.0 or higher), web browser (US only)

STIRR

Owner: Sinclair Broadcast Group

Launched: 2019

Territories: US

Linear IP channels: 120+

On-demand catalogue: 8,000+ hours

Devices: Samsung Smart TVs, Roku, Apple TV, Amazon Fire TV, iOS, Android

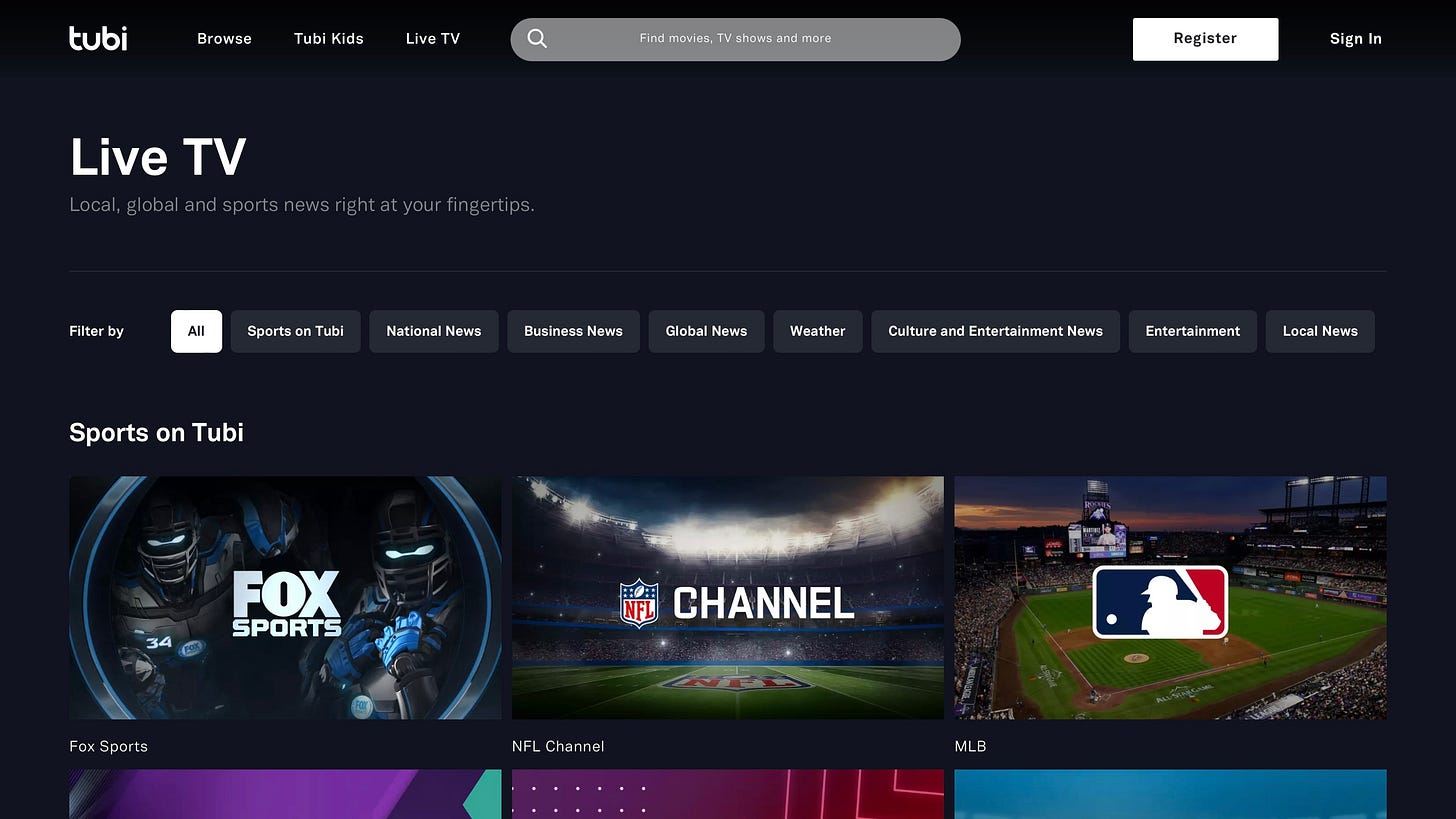

Tubi

Owner: Fox Corporation

Launched: 2014

Territories: US, Canada, Mexico, Japan, Australia, New Zealand (not available in the UK or EU since GDPR came into force in May 2018)

Linear IP channels: 55+

On-demand catalogue: 20,000+ titles

Devices: iOS, Android, Roku, Amazon Fire TV, Vizio, PlayStation, Xbox

WatchFree+

Owner: Vizio

Launched: 2018

Territories: US

Linear IP channels: 240+

On-demand catalogue: 5,000+ titles

Devices: Vizio SmartCast TVs

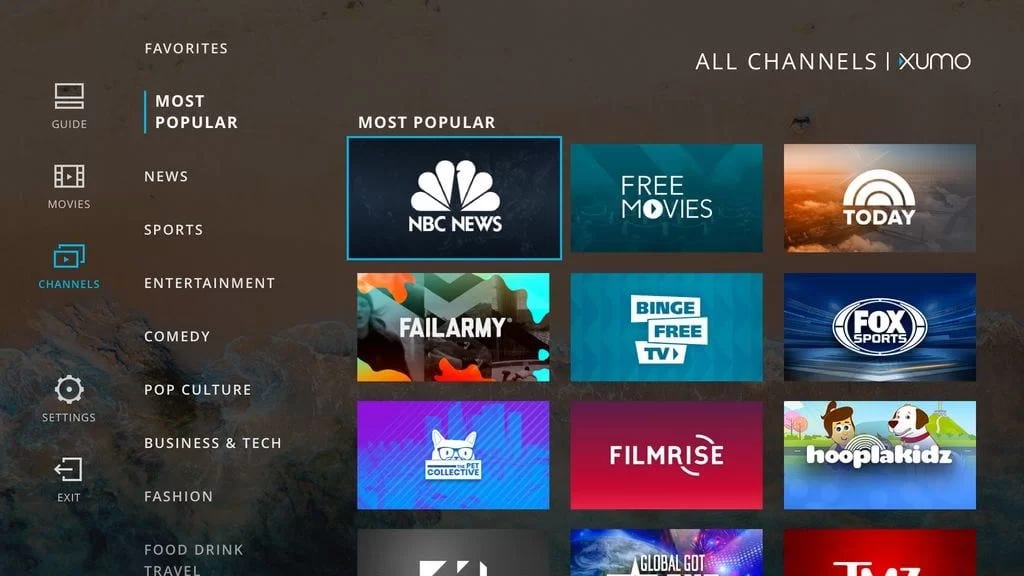

XUMO

Owner: Comcast

Launched: 2011

Territories: US

Linear IP channels: 180+

On-demand catalogue: 2,000+ titles

Devices: iOS, Android, Hisense, Magnavox, Panasonic, Philips, Sanyo, Sharp, Sony and VIZIO Smart TVs